Print Fix Hub

Your go-to source for everything print-related, from troubleshooting to tips.

Fueling Fintech: Instant Crypto Transactions and Their Impact on the Economy

Discover how instant crypto transactions are revolutionizing finance and reshaping the economy. Dive into the future of fintech today!

How Instant Crypto Transactions are Reshaping Global Trade

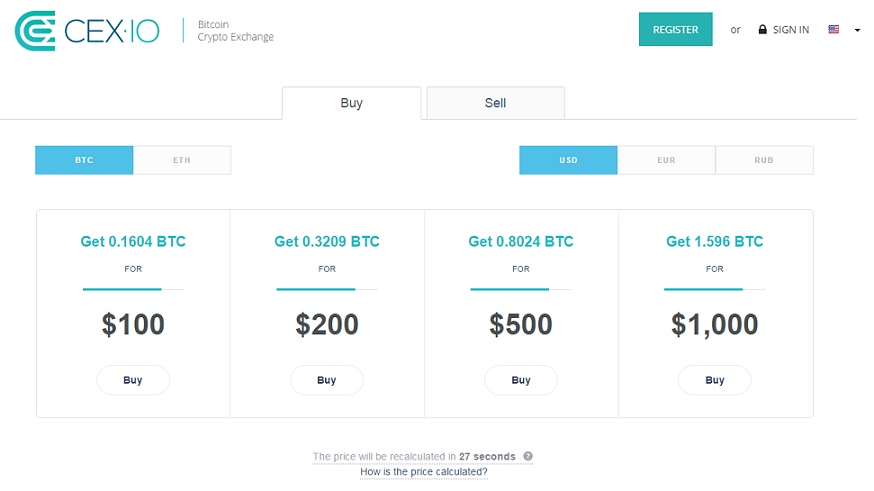

The rise of cryptocurrency has revolutionized the way businesses engage in global trade, primarily through instant crypto transactions. Traditional banking systems often impose delays and hefty fees for international transfers, which can hinder the speed and efficiency of trade. In contrast, cryptocurrencies allow for real-time transactions that bypass these limitations, enabling businesses to settle deals rapidly and securely. As a result, companies are increasingly adopting cryptocurrency payment systems to streamline their operations and enhance competitiveness on the global stage.

Moreover, instant crypto transactions provide greater accessibility to emerging markets, enabling small and medium-sized enterprises (SMEs) to enter international trade without the traditional barriers set by banks. This shift is significant, as it empowers entrepreneurs around the world, facilitating direct trade relationships and fostering economic growth. As adoption rates rise, it is clear that cryptocurrency is not just a financial tool but a catalyst for a new era of global commerce, where speed, efficiency, and inclusivity take center stage.

Counter-Strike is a highly popular tactical first-person shooter that pits teams of terrorists against counter-terrorists in a variety of game modes. Players must work together to complete objectives, such as bomb defusal or hostage rescue, while utilizing strategy and skill. For gamers looking to enhance their online experience, be sure to check out the bc.game promo code for special offers.

The Economic Benefits of Instant Crypto Transactions Explained

The rise of blockchain technology has revolutionized the way we conduct financial transactions, with instant crypto transactions leading the charge. These transactions eliminate the need for intermediaries, such as banks, which can often slow down the process and incur heavy fees. By utilizing cryptocurrencies, businesses and consumers can enjoy faster transaction speeds, typically within seconds, alongside lower operational costs. This newfound efficiency not only boosts cash flow but can also enhance a company's profitability, making it a compelling option for both small and large enterprises.

Moreover, the economic benefits of instant crypto transactions extend beyond immediate savings. Businesses that adopt cryptocurrency can attract a broader customer base, including those who prefer digital payments over traditional methods. As a result, a growing number of merchants are beginning to accept cryptocurrencies, thus contributing to the overall adoption of digital currencies as a legitimate medium of exchange. This trend can stimulate economic growth, create new job opportunities in the tech and finance sectors, and foster an innovative environment for financial services.

What You Need to Know About Instant Crypto Transactions and Their Economic Impact

Instant crypto transactions have revolutionized the way we think about and use money. These transactions enable users to send and receive cryptocurrencies within seconds, eliminating the long waiting periods often associated with traditional banking systems. With the rise of technologies like the Lightning Network and solutions built on blockchain, the economic impact of instant transactions is monumental, facilitating better liquidity and enabling microtransactions that were previously unfeasible. This immediacy opens doors for businesses, especially in sectors like e-commerce, where rapid transaction processing can enhance customer experience and foster trust.

The economic impact of instant crypto transactions extends beyond just individual users and businesses. As more individuals embrace cryptocurrencies for daily transactions, we may see a shift in how currencies are perceived globally. Governments and financial institutions are beginning to take notice, considering how to adapt to this burgeoning landscape. Furthermore, with lower transaction fees associated with instant crypto transfers, consumers can save more in transaction costs, paving the way for broader adoption of digital currencies in the mainstream economy.